Are you looking for instant loan apps in India? If so then your search ends here. Today I am going to share a super detailed guide about loan apps for Personal and students.

Everyone needs a little extra money every now and then, and sometimes it can be hard to find a loan that’s made for students if you don’t have access to resources.

Fortunately, you got it today. Now you are reading one. Gone are the days when you had to spend hours at the bank, filling out credit card apps. The internet has changed everything. Now it’s just a matter of a few clicks to get loans. Without further ado,

First of all, I would like to say that for whom is it right to take a loan?

If you have any source of income and you know that at the end of the month you will have twenty or thirty thousand rupees in your pocket. And if you need two or three thousand rupees, you can take it.

Why need an Instant loan?

There are many reasons why people in India might need to take out a loan. Perhaps they need to pay for an unexpected medical expense, or they need to make a down payment on a car.

Whatever the reason, there are now several instant loan apps available in India that can help people get the money they need quickly and easily.

One of the most popular instant loan apps in India is MobiKwik. MobiKwik allows users to take out loans of up to Rs. 1 lakh. The loan amount is instantly credited to the user’s MobiKwik wallet, which can be used to pay for various expenses.

MobiKwik also offers a flexible repayment period, which can be as short as 15 days or as long as 36 months.

Another popular instant loan app in India is LoanTap. LoanTap offers loans of up to Rs. 5 lakhs for a tenure of up to 3 years. The loan amount is disbursed within 24 hours, and there are.

Sometimes we try to find an Instant personal loan application. We all need money in our daily life, but for some emergency cases, we need a personal loan.

Because the amount of money needed for that important work or student is not in our hands at the time. That is why we apply for an instant personal loan.

What document needs for an Instant loan?

When you need an instant loan, the first thing you need to do is gather the required documents. Depending on the type of loan you are applying for, the requirements can vary. But there are some common documents that you will need to have in order to get approved for a loan.

The most important document you will need is your ID. This can be a driver’s license, passport, or other forms of government-issued ID.

You will also need to provide proof of income. This can be in the form of pay stubs, tax returns, or other financial documents.

If you are applying for a secured loan, you will also need to provide collateral. This can be in the form of a car, property, or other assets.

The lender will use this as security in case you default on the loan. Once you have all of the required documents, you can apply for an instant loan online or in person. The approval process is usually quick, and you can get it.

Instant loan for students in India

As a student in India, you may not have much money to spare. But when unexpected expenses come up, you may need a loan to help you cover the cost. Luckily, there are several instant loan apps that can help you get the money you need quickly and easily.

One of the best instant loan apps for students in India is KreditBee. With KreditBee, you can get a loan of up to Rs. 1 lakh in just a few minutes. The application process is completely online and you can get your money in as little as 24 hours.

Another great option for instant loans is LoanTap. LoanTap offers loans of up to Rs. 5 lakhs with flexible repayment options. You can choose to repay your loan in EMIs or lump sum payments, whichever is more convenient for you.

If you need a larger loan, you can also check out Paysense. Paysense offers loans of up to Rs. 10 lakhs and you can get your

Best Instant Loan Apps for in India

It’s super easy to get loans if you are a salaried or self-employed person. There are many financial companies that offer loans to a person who has a regular source of income.

But when it comes to loans for students, there are not many options. As a student, it can be confusing to choose the best loan app.

I found some of the best loan apps for Personal and students.

Let’s see loan apps in India.

20 Instant Personal loan apps in India

1. mPokket

mPokket is a good and trusted instant personal digital loan app in India. There are multiple types of loans such as Cash, Easy, Quick, & Short Term. Over 7 million users trusted this app. The loan amount can be taken is from Rs.500 to Rs.30,000. mPokket interest rate is from 2 to 6%. You can transfer the amount to your bank account or Paytm account.

You will be charged a processing fee ranging from Rs 34 to Rs 203 + 18% GST depending on the loan amount with a maximum APR (Annual Percentage Rate) of 120%.

Eligibility

- Age must be above 18 years.

- Student/Salaried

Document Required

- Aadhaar Card, Driving license, or Voter ID card

- PAN Card

- Collage Identity Card

- Last 3 months Bank Statement for Salaried Professionals

2. KreditBee Loan app

KreditBee is providing Instant personal loan with limited paperwork. Get a personal loan as low as ₹1,000 to a maximum of ₹3 lakhs’.

Reasons to Apply for CreditB Loan:

- It can be easily applied online

- Loan Tenure – From 2 to 15 months

- Transferred directly to the bank

There 3 types of loans on KreditBee:

1. KreditBee Card, 2. Flexi Personal Loan, 3.Self-Employed, 4. For Salaried, & 5. Online Purchase Loan.

Eligibility

- Salaried/Self Employed

- Your age should be 21 years or above

Document Required

- ID Card (Aadhaar, Voter ID, Driving License.

- Address Proof

- PAN Card

- Income Proof

If you use this code ABDHRKUKU you will get Rs 75 also you can download app using below link.

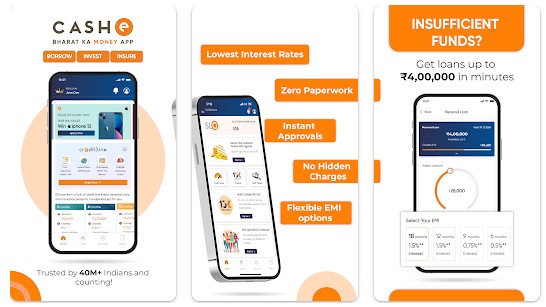

3. CASHe Loan app

CASHe offers instant personal loans without credit history. Short-term loans starting from ₹1,000 to ₹4, 00,000 and transfer money to your bank account instantly.

Reasons to choose CASHe for Apply Loan:

- Easy online application process

- Loan tenure – 90 days to 540 days

- Very fast loan disbursement

4. Fibe loan app

Fibe is the best loan app that single credit line for every credit need of young working professionals. This is a one-stop solution for all your instant cash needs.

Reasons to Apply for Fibe Loan:

- 100% online application process

- Loan tenure is up to 36 months

- Fast loan disbursement

5. NIRA Finance

Looking for a personal loan? Get an instant NIRA personal loan of Rs. 1 lakh. NIRA app can be good for those who are looking for the best way to get loan online.

Reasons to Apply for Nira Finance:

- Easy online application process

- Loan Tenure – 3 to 12 months

- Minimum documentation

6. MoneyTap app

Looking for a safe and reliable platform for urgent funding needs? MoneyTap is here to provide you with a line of credit to meet your financial needs. Get cash in your account instantly with MoneyTap.

Benefits of availing of MoneyTap Personal Loan:

- Credit limit allowed up to ₹5 lakh

- Borrow flexibly

- Safe and secure credit

7. Privo

Do you need an instant loan? Then Privo is what you need. Get an instant line of credit up to Rs 2 lakhs to fulfill all your needs.

Top benefits for you:

- The easy online application process

- Flexible EMI

- Instant approval and fast delivery

Why you should apply from here:

- 100% Fast and Safe

- Paperless documentation

8. TrueBalance

TrueBalance is an Indian personal loan application. It is trusted by 75 million users. The app is for non-credit scores. Even you don’t need any collateral or guarantor. You can take loans from Rs.5,000 to Rs.50,000.

The loan tenure is 62 to 116 days. TrueBalance APR ranges from 50% 154.8%. APR includes interest and fees as well. 100% paperless process & instant loan TrueBalance.

Eligibility

- Salaried

- Age should be 18 or above

Document Required

- Aadhaar Card/Driving License

- PAN Card

Bank Statement

9. StuCred

As you can the name says that it is a dedicated student loan app. StuCred offers loans from Rs.1000 to Rs.10,000. The best thing about StuCred is you don’t need to pay interest if you pay the loan amount within 90 days. That means 0% interest.

Just you need to pay the processing fee of Rs.60. The whole process to get a loan is paperless. Once you signed up and entered the VPA, you will get the amount into your bank account.

Eligibility

- You must be a college student

Document Required:

- Aadhaar Card, Driving license, or Voter ID card

- PAN Card

- Collage Identity Card

10. BharatPe

BharatPe (previous name was postpe) is one of the most popular loan and payment gateway services in India with more than 10 million installs with 4.3 * rating in Play Store. You will get a VISA card which you can use as a credit card. PostPe charges 18-27% interest annually. You don’t need to pay any processing fees.

You can get easy loan from Rs.1000 to Rs.10,00,000 without any collateral. The loan amount can be transferred to your bank account.

Eligibility

- You must be 18 or above.

Document Required

- Aadhaar Card

- PAN Card

11. Slice

Slice is relatively new in the BNPL market. But they have already dominated the industry. You will receive a Visa card. There is no joining fee. It takes only 5 minutes to approve your card. Once it is approved you will get a credit limit of Rs.2,000 to Rs.10,00,000. It can be transferred to your bank account or Paytm account.

You will get up to 2% cashback on every transaction. Slice is tied up with giant e-commerce to provide offers & no-cost-EMI.

It’s best for shopping online as you can pay your bills in 3 months without any extra charges. The interest is 6-8% for 6 months tenure and it goes up to 12-15 for 1 year.

- Nationalized banks in India Know the detail

- How to get Free Virtual Debit Card in India

- How to Open an Online Bank Account in SBI

- Top list of private banks in India | Explain Details

Eligibility

- You must be 18 years or above

Document Required

- Aadhaar Card

- PAN Card

- Income proof for salaried

12. Paytm Postpaid

Paytm Postpaid is another popular BNPL service in India. Yes Paytm also offers you a loan. There’s a huge chance that you have already a Paytm account. But do you know Paytm also offers loans? And do you know the best thing you don’t need any income proof or collateral? You can get credit up to Rs.60,000. There’s no fee if you pay the amount within 30 days.

Paytm does charge a fee if you are unable to pay the amount within 30 days. You can check the details on the Paytm blog.

100% paperless work and no need activation fee.

Eligibility

- You must be an active Paytm user.

- You must be 20 years or older.

Document Required

- PAN Card

Read more: 30 Paytm Earning Apps | Earn ₹500 Paytm Cash Daily

13. BadaBro

BadaBro is a new Instant loan for students and salaried persons. The app is getting popular, currently, it has over 100,000 happy customers. You can get a loan of up to Rs.10,000. The amount is quite low compared to most BNPL apps. The amount can be instantly transferred to your bank or Paytm account.

The processing fee is from Rs.34 to Rs.203 + 18% GST depending on the loan amount with a maximum APR of 120%.

Eligibility

- Student or Salaried

Document Required:

- Aadhaar Card

- PAN Card

- Office/College ID Card

- Bank Statement

- Salary Slip/Mark Sheet

14. ZestMoney

ZestMoney is the best loan app for shopping online. It allows you to shop over 85,000 online & offline retailers like Amazon, Flipkart, Myntra, Reliance Digital, etc. No down payment is needed to shop online. Zest offers credit from Rs.1,000 to Rs.2,00,000.

You don’t need to pay any joining or annual charges. The maximum cost can be 36% including interest and processing fees.

Eligibility

- Salaried/Self Employed

Document Required

- Aadhaar Card

- PAN Card

- Income Proof

Read more: Make money online in India for students

15. Bajaj Finserv

Bajaj Finserv is a finance service by Bajaj itself. You can get an EMI card to shop online. Finserv card is used to avail of no-cost-EMI. You need to pay Rs.530 fee to get the EMI card. The company allows us to take loans from Rs.30,000 to Rs.25,00,000. And the repayment tenure is 12 to 84 months. The rate of interest is 12% to 34% on Bajaj Finserv + Rs.500 to Rs.2,000 processing fee.

Eligibility

- Salaried/Self Employed

- You must be 18 years or above

Document Required

- PAN Card

- Aadhaar Card

- Cancelled Cheque

- Signed ECS Mandate

16. Pocketly

Pocketly is a loan app for youngsters. You don’t need any income proof to borrow money. The loan amount starts from Rs.500. To increase the amount you need to repay the loan amount in time and over time your credit limit will increase to Rs.10,000.

There are neither joining fees nor annual charges. The APR is 12% to 36%. You have to pay processing fees of Rs.20 to Rs.120 + GST. The loan tenure is 61-90 days. You can also earn cashback through the Pocketlty referral program.

Eligibility

- Your age should be 18+

- Student

Document Required

- Aadhaar Card

- PAN Card

- Collage ID

17. Kreditzy

Kreditzy is an personal loan app. You can take loans from Rs.1,000 to Rs.100,000 according to your credit limit. The interest rate depends on loan tenure and the customer’s risk profile. Actually, interest depends on loan tenure and the customer’s risk profile. The loan tenure is 91 days to 365 days.

You don’t need any collateral to get loans on Kreditzy. The process the 100% online with minimal documentation. Kreditzy app is not available in the Play Store, you can download it from the Kreditzy official site.

Eligibility

- Your age should be 21 years+

- Salaried

Document Required

- Aadhaar Card

- PAN Card

18. PayMe

PayMe is a collateral-free loan. The company has over 2.5 lakhs, happy customers. They disbursed over Rs.1,000 crores as loans. You can take loan from Rs.2,000 to Rs.2,00,00,000. The loan tenure is 3 months to 24 months. The processing fee is Rs.100 to Rs.5,000 excluding GST. PayMeIndia APR ranging from 18% to 36%.

Eligibility

- Your age should be 18 to 56 years

- Salaried

- The minimum CIBIL score required is 650

Document Proof

- Driving License/Voter ID/Passport/Aadhar/PAN

- Address Proof (Driving license/Voter ID/Passport/Aadhar/ bills/bank statements).

- PAN Card

19. LazyPay

LazyPay is a BNPL service by PayU, one of the most popular payment methods in India. You might have already heard about the brand PayU. You can get a credit limit between Rs.10,000 to Rs.100,00,000 without any collateral.

The loan interest rates range from 15% to 32% per anum. And you will charge Rs.200 processing fee as well. You can also shop online using LazyPay and convert the amount into EMI. LazyPay converts your phone into a credit card. You can pay with UPI with credit and pay later.

Eligibility

- Salaried

- Your age should be 22-55 years.

- You should live in tier-1 or tier-2 cities in India.

Document Required

- Proof of Photo ID

- Proof of Address

- Income Proof

20. Moneyview

Moneyview is a individual loan app that allows you to take a loan within 2 minutes. You can borrow from Rs.5,000 to Rs.50,000 with repayment terms of up to 5 years. Money View charges interest from 16% to 39% per anum. You have to pay a processing fee (2-8%) + GST. There’s no activation or annual fee.

Eligibility

- Salaried/Self Employed

- Your age should be between 21 to 57 years

- Minimum CIBIL score of 600

Document Required

- Identity Card (Aadhaar Card or PAN)

- Address Proof

- Bank Statement

21. Sahukar

Sahukar is a loan app for students. Yeah, you don’t need a credit score to get a loan from this app. They give loans from Rs.500 to Rs.5,000. The amount can be transferred to your bank/Paytm account. You will get 91 days to repay the amount. The Sahukar app has over 7 crores of users. Sahukar charges 36% interest annually, and you will also be charged a processing fee & GST.

Eligibility

- Student

Document Required

- Aadhaar Card

- PAN Card

- Student Identity Card

22. Olyv (SmartCoin)

Olyv (SmartCoin) is another instant loan app where you can get a collateral-free loan easily. With a loan tenure of 91 days to 270 days, you can get loans from Rs.1,000 to Rs.70,000. It takes only 5 minutes to approve a loan. The amount can be transferred to your account just within a few hours. SmartCoin charges up to 30% interest per anum.

The minimum APR is 20% and the maximum is 36%. The whole process of getting a loan is digital.

Eligibility

- Salaried professionals or Business owners

- You should be 23 years old

Document Required

- PAN Card

- Address Proof

- Bank Statement

23. Flexsalary

Last but not least FlexSalary is an instant loan app for salaried persons. You will get a credit limit of up to 2 lakhs without collateral. The annual percentage rate (APR) is 36% with a loan tenure of from 10 months to 36 months. You have to pay a one-time processing fee from Rs.300 to Rs.750 including GST. There’s no late fee or bounced cheque fee. FlexSalary has a high approval rate for loans.

Eligibility

- Salaried

- Your age should be 21 years above

Document Required

- Identity Proof (Aadhaar Card/Voter ID/Driving License/Passport /)

- PAN Card

- Address Proof (Driving License / Passport/ Utility Bills / Aadhaar / Bank Statements / Voter ID)

- Net banking verification for validating your income

Conclusion

These are my handpicked Instant loan apps for India. I hope this post will help you find an instant loan. Let us know in the comments below which app you are going to use or which one you are already using.

Note:- Loan as much as you can afford. and do not take loans on the instructions or temptations of anyone. Look carefully at the interest rates and other fees before taking any loan.